Having been a CAB budget advisor some time ago, I've concluded most people aren't interested in budgeting. That doesn't mean it doesn't work - but as with business advice, it only works when people buy into it. Without that, nothing else, no matter how simple or sophisticated, will work.

I have heard more stories than you can imagine - but a classic case was a couple I graded (in my mind) as unlikely to succeed. They had little going for them, but through coming up with a budget and sticking with it, they got out of debt - and even bought a home. And if you're thinking your income means you don't need to budget, you're wrong. One thing that amazed me, watching a variety of people, was that there was no income pattern common to those in difficulties. The example couple succeeded despite their low income - most of the "failures" had higher incomes. So I decided to write on budgeting in the hope that it might help at least one reader.

There are some basic things needed to start. For example, you have to know how much you are currently earning and spending. Chances are, earning won't take too long - but few people have a detailed idea of what they spend. When I first started budgeting, I was shocked at the amount that went into a black hole, commonly called "general" or "miscellaneous". It takes time to build up a reliable picture, and the more complete this is, the better.

While you're doing that, you need to build a list of your assets and your liabilities. If you have more realisable assets than debts, that's a good start. If you can't pay debts when they're due, that's not good. But if you let it slide, it will only get worse. If it's not too bad, come up with a plan and see if your creditors will run with it. If it's more serious, talk with a budget advisor as soon as possible.

This article is not about rescue from bad situations. Rather, it is how to run your finances so they don't end up running you. For a budget, you need three things: income, expenses and goals.

Income is fairly easy for most. Where your income is not regular, you need to think a little differently. For example, you may budget a minimum amount of income, and have a secondary part to the budget for income over this.

Expenses are where the rubber really meets the road. Almost invariably, income doesn't cover desired expenses. And the keyword is desired. When you look at it in the cold light of day, you're almost certainly going to have to trim your desires. In fact, it's worse than that. If you pay expenses annually, it's easy not to save for these costs. Some people find it easier to take monthly payments, which is great, but it usually costs more. So, as well as a budget, it pays to have a cash flow, preferably for a year.

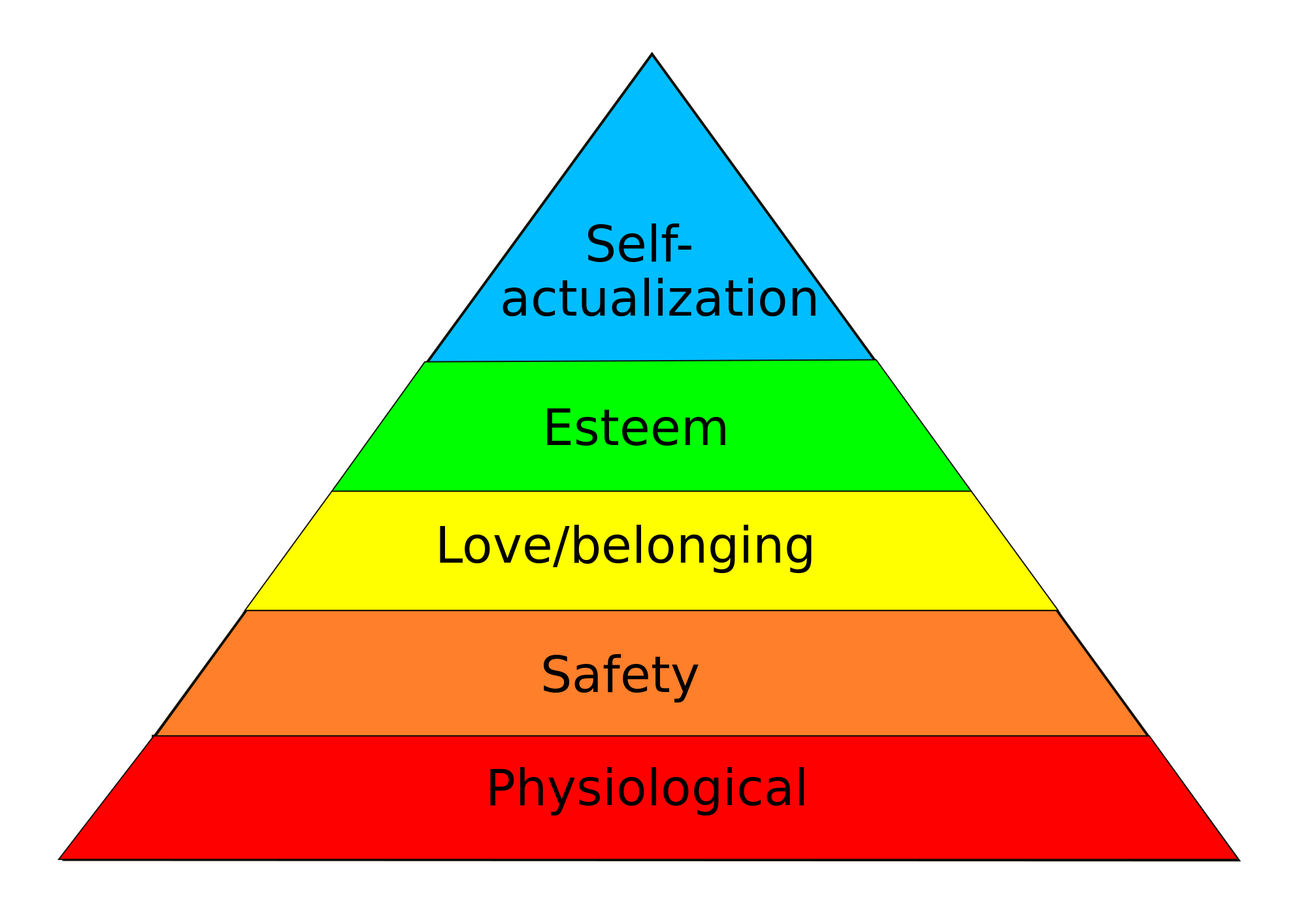

The third component is goals. Applying Maslow's hierarchy of needs (above) we should aim to have an emergency fund available to help us survive when an emergency affects our income. We need at least two weeks - but a month would be more typical - and more may be necessary at times, depending on circumstances.

We have to plan for the things in life that are above mere survival, like nice food and drink, insurances, entertainment & holidays, etc. All of these items should be covered by income rather than debt. Debt costs money and may give you short-term benefit - but the extra costs at best will slow your progress toward your bigger goals. At worst, they'll dig a trench that can be difficult to get out of.

Lastly, there are long-term goals - transport, a home, retirement or whatever. Usually, you'll have multiple goals and need to prioritise these. And this is where debt can come in. Debt will add to your costs, and should generally be avoided - but the classic is a house. Generally, it's only feasible to buy a house with a mortgage.

Even then, you need to consider all eventualities. Maximising the house and mortgage is very bad advice - although sometimes you have little option. An example of this is the Auckland situation, where house prices were out of control. It has its own risks - you don't want to buy a house only to have the market crash. Set your maximum price to leave room for unexpected events. Leaving no room for extras can mean an extended time on bare living costs - no extras. And this is hard long term. Ask long-term beneficiaries.

Sadly, this is all a waste of time - a budget doesn't actually do anything. You can have the most sophisticated budget conceivable - but it means nothing - until it is used. That means comparing actuals (which means recording ALL expenditure) with the budget - and acting upon variances. It may mean cutting back on certain items - or amending the budget to reflect reality (including increased prices).

And a budget shouldn't stay static. It needs to reflect the changing world - to become a living tool.

One last point: debt. People have a range of views of debt - from it is to be avoided at all costs, to it's great. Not surprisingly, my view is in the middle. Debt to fund consumption (or business debt to fund operating costs) is a recipe for financial disaster - or at least struggles. However, debt for investment, assuming the investment returns more than the debt costs, may be a sound decision.